When Gov. Mike Pence signed into law last week a $400 million highway spending bill, he claimed projects funded by the new spending would create nearly 10,000 new jobs. WTHR's Bob Segall fact-checks the claim and find it's bogus. The governor's office relied on a 2007 federal highway report that suggested that every $1 billion spent on highway spending equates to about 27,800 jobs. The job claim number used by the governor's office was extrapolated from that estimate.

What Segall found was that the 2007 report cautioned that the job numbers referred to the number of jobs supported by the spending, not the actual number of new jobs created by the spending. Segall also found another more recent federal report that suggested the actual number of jobs supported by $400 million in spending would be closer to 4,300 jobs rather than the 9,800 job number touted by Pence.

In a separate report this past weekend by the Evansville Courier & Press, questions were raised about the wisdom of Gov. Pence's plan to build the I-69 extension from Bloomington to Martinsville through the use of a public-private agreement. The Pence administration has awarded the project to a Netherlands-based company, Isolux Infrastructure, to upgrade the 21-mile stretch of State Road 37 as another connecting link for I-69. The state will kick in $80 million upfront, while the private contractor will provide $325 million in funding for the extension. In addition, Indiana will make annual payments of $21.8 million to the private consortium over the next 35 years, or a total of $763 million, in exchange for the private consortium agreeing to maintain the highway.

By comparison, $700 million in Major Moves funding was provided for construction of the the nearly 100-mile stretch of new highway from Evansville to Bloomington. State Road 37 between Martinsville and Bloomington is already a 4-lane interstate quality highway absent the interchanges. It looks like Pence is just relying on a public-private agreement for the sake of privatization without any regard to the the extra cost future generations of taxpayers will bear to pay for this small stretch of highway. I hate to see the tab for the final leg between Martinsville and Indianapolis.

Dedicated to the advancement of the State of Indiana by re-affirming our state's constitutional principles that: all people are created equal; no religious test shall be imposed on our public officials and offices of trust; and no special privileges or immunities shall be granted to any class of citizens which are not granted on the same terms to all citizens. Advance Indiana, LLC. Copyright 2005-16. All rights reserved.

Monday, March 31, 2014

Sunday, March 30, 2014

Walgreen's Executive Used Pharmacy Board Position To Win Approval For Company's "Well Experience"

The Star's John Russell has a disturbing investigative story today about how William Cover, a corporate manager of pharmacy affairs for Walgreen's, used his position as chairman of Indiana's Board of Pharmacy to convince other members of the board to approve Walgreen's "Well Experience" program. "The plan was to move pharmacists out from behind the counter to a workstation on the floor, where they could answer questions from the public and provide health counseling," Russell writes. "Indiana was the pilot site."

As you might imagine, this approach to providing pharmacy services potentially compromises patient privacy and increases the chances of errors in filling prescriptions. Phil Wickizer, who Gov. Daniels had appointed as executive director of the pharmacy board's staff, exchanged numerous e-mails with Cover discussing the "Well Experience" program and arranging trips for the pharmacy board members to make to a site in Illinois to meet with Walgreen's officials and see the new design. The e-mails were obtained by a watchdog group, Change to Win, through numerous public records requests. In a highly unethical move, Wickizer wrote in one e-mail to the Indiana Professional License Agency: “Walgreens wants to partner with the Board and get your buy-in before making such a commitment. He said the company wanted to keep the plans confidential. I told them this would not be an issue.”

When the professional license agency raised concerns with Wickizer that the meeting with Walgreen's officials by board members would violate Indiana's Open Door Law, Wickizer wrote to Walgreen's officials that it would be necessary to break the meeting up into two separate trips to prevent a quorum of the board members from being present at the same time. Cover at one point inquired of Wickizer whether the other board members reacted favorably to the plan. After Wickizer responded that at least three of the six other board members had responded affirmatively, Cover wrote back: “Thanks for all your hard work on this project. It is certainly appreciated.”

When the board met on July 11, 2011 to consider Walgreen's proposal, it voted 6-0 to support it. Cover abstained from the vote after engineering its approval behind the scenes with Wickizer's assistance. Neither Wickizer, who is an attorney, nor other members of his staff bothered to research Indiana law to determine if what Walgreen's proposed doing complied with state laws and regulations in their rush to get approval of the plan. It didn't. Two years after Walgreen's plan was approved, the pharmacy board adopted new regulations to permit the type of remote supervision authorized by the board's action two years earlier. Watchdog groups claim that the plan clearly violates patient's privacy rights.

As you might imagine, this approach to providing pharmacy services potentially compromises patient privacy and increases the chances of errors in filling prescriptions. Phil Wickizer, who Gov. Daniels had appointed as executive director of the pharmacy board's staff, exchanged numerous e-mails with Cover discussing the "Well Experience" program and arranging trips for the pharmacy board members to make to a site in Illinois to meet with Walgreen's officials and see the new design. The e-mails were obtained by a watchdog group, Change to Win, through numerous public records requests. In a highly unethical move, Wickizer wrote in one e-mail to the Indiana Professional License Agency: “Walgreens wants to partner with the Board and get your buy-in before making such a commitment. He said the company wanted to keep the plans confidential. I told them this would not be an issue.”

When the professional license agency raised concerns with Wickizer that the meeting with Walgreen's officials by board members would violate Indiana's Open Door Law, Wickizer wrote to Walgreen's officials that it would be necessary to break the meeting up into two separate trips to prevent a quorum of the board members from being present at the same time. Cover at one point inquired of Wickizer whether the other board members reacted favorably to the plan. After Wickizer responded that at least three of the six other board members had responded affirmatively, Cover wrote back: “Thanks for all your hard work on this project. It is certainly appreciated.”

When the board met on July 11, 2011 to consider Walgreen's proposal, it voted 6-0 to support it. Cover abstained from the vote after engineering its approval behind the scenes with Wickizer's assistance. Neither Wickizer, who is an attorney, nor other members of his staff bothered to research Indiana law to determine if what Walgreen's proposed doing complied with state laws and regulations in their rush to get approval of the plan. It didn't. Two years after Walgreen's plan was approved, the pharmacy board adopted new regulations to permit the type of remote supervision authorized by the board's action two years earlier. Watchdog groups claim that the plan clearly violates patient's privacy rights.

Change to Win said it has made more than 100 visits to Well Experience stores and has found widespread risks to patient privacy and public health. Pharmacists often leave their desks in a public area of the store to talk to patients in consulting rooms or to unlock a cabinet in the dispensing area.

When the pharmacist leaves, the public can look at the computer screens or at labeled bottles of medicine on their desk, the organization said. About 80 percent of the stores visited violated privacy laws in this way, the group alleged.A year after the pharmacy board approved Walgreen's "Well Experience" program, Wickizer landed a job as a senior counsel at St. Louis-based Express Scripts, a pharmacy benefit manager giant. This is the same company that has partnered with Walgreen's to form an alliance to compete against Walgreen's chief competitor, CVS, and its CVS Caremark, a mail-order pharmacy business. Under their alliance, Walgreen's customers have the choice of filling their prescriptions for 90 days at one of its pharmacies, or by receiving 90-day supplies of their drugs delivered to their home. Cover still sits on the pharmacy board, although he no longer serves as its chairman. I wonder what kind of a bonus he got from Walgreen's for pulling this fast move off? This pretty much seemed to be standard operating procedure in the Daniels' administration for appointees to blatantly use their positions in government for self-dealing purposes.

Lafayette's Gain Is Fort Wayne's Loss

State officials haled a decision this week by GE Aviation to locate a jet engine manufacturing plant in Lafayette this week that will eventually employ about 200 employees. The plant will build engines to be used in Boeing's 737 MAX and Airbus' A320neo. State officials awarded the company incentives worth at least $5 million, while Lafayette officials will grant the company a 10-year tax abatement.

A story getting less play in the media was the announcement made only a day later that GE will close its motor testing lab and executive center in Fort Wayne, the last two facilities it operated in Fort Wayne where the company once employed 10,000 workers. The closures will result in the loss of about 90 jobs, which the company is moving to Monterrey, Mexico.

A story getting less play in the media was the announcement made only a day later that GE will close its motor testing lab and executive center in Fort Wayne, the last two facilities it operated in Fort Wayne where the company once employed 10,000 workers. The closures will result in the loss of about 90 jobs, which the company is moving to Monterrey, Mexico.

Bloomington's Parking Meters Net $1 Million In Six-Month Period

Indianapolis officials were recently gloating that its privatization agreement for the city's parking meter assets netted the City $3 million in the most recent year. The City of Bloomington, which has a population less than one-tenth the size of Indianapolis, installed electronic parking meters in its downtown area last year to generate revenues to pay for sidewalk and street improvements. In its first six months of operation, the city-owned parking meters netted the City $1 million. Bloomington parking meter rates are $1 an hour compared to $1.50 an hour in downtown Indianapolis and Broad Ripple. If that rate of revenue generation persists, Bloomington will net about $2 million annually. If Indianapolis had simply installed its own electronic meters and not entered into the 50-year lease of the parking meter assets with ParkIndy, the City would be generating more than $6 million annually. The amount of revenues the City will give away to the private vendor over the life of the 50-year lease is staggering, but it's making a lot of money for the pay-to-play vendors and that's all that seems to matter with this administration.

Thursday, March 27, 2014

IMPD Officer Facing Criminal Charges

A young IMPD officer, Corey Owensby, son of FOP President Bill Owensby, has been indicted by a Marion County grand jury on multiple charges of misconduct and false reporting according to the Indianapolis Star. Charging documents cite five different cases over the past couple of years where Owensby mishandled evidence. He faces 13 criminal counts, including 5 counts of official misconduct, a Class D felony. Owensby has been suspended without pay pending a termination hearing before the merit board. “Any misconduct by one of our employees is taken seriously,” said IMPD Chief Rick Hite in a statement Thursday. “I want the community to know that IMPD’s internal systems identified the issue and we acted on the accusations. Officers are expected to act within department policies and the law; those who choose not to will be held accountable.”

A young IMPD officer, Corey Owensby, son of FOP President Bill Owensby, has been indicted by a Marion County grand jury on multiple charges of misconduct and false reporting according to the Indianapolis Star. Charging documents cite five different cases over the past couple of years where Owensby mishandled evidence. He faces 13 criminal counts, including 5 counts of official misconduct, a Class D felony. Owensby has been suspended without pay pending a termination hearing before the merit board. “Any misconduct by one of our employees is taken seriously,” said IMPD Chief Rick Hite in a statement Thursday. “I want the community to know that IMPD’s internal systems identified the issue and we acted on the accusations. Officers are expected to act within department policies and the law; those who choose not to will be held accountable.”Calumet Township Trustee's Office In Lake County Raided By FBI

Well, the FBI is raiding government offices everywhere else but here in Indianapolis it seems where wholesale fraud of taxpayers is occurring on a daily basis. Today, FBI agents descended on the Calumet Township Trustee's Office in Lake County. A search warrant was served on Trustee Mary Elgin (D) in Gary as part of a joint effort by the FBI, the IRS and Indiana State Police. Spending by Elgin's office has been under a microscope for some time according to the Northwest Indiana Times. Calumet Township's tax rate is 22.6 times the state average. A Times investigation found that her office spends almost as much on employee salaries and administrative expenses as it does on assistance for the poor.

Firing Of Two Hendricks County Deputies Sought Over $250,000 They Were Safe-Keeping For Man

Details have emerged to explain why Hendricks County Sheriff Dave Galloway wants two of his deputy sheriffs fired from their jobs. The husband and wife duo, Jason and Teresa Woods, were allegedly safe-keeping $250,000 for a man in a built-in safe inside their new Brownsburg home when the owner of the money says it went missing. Neither Woods showed up for a merit review hearing scheduled concerning their employment yesterday.

According to WTHR's Steve Jefferson, a private investigator for the owner of the missing money hired him to help track it down. The private investigator interviewed Deputy Woods, who identified himself as a photographer rather than a deputy sheriff. Woods allegedly told the private investigator he was to deliver the money to a man at a local McDonald's restaurant where the two would exchange passwords to identify themselves. As Jefferson explained:

Deputy Woods was to deliver the money by saying, "Oysters with pearls are in the river" and receiving the response, "When monkeys fly." The deputy reportedly says that's just what happened, so he no longer has the money. Deputy Woods allegedly took a photo of the person's car, an unoccupied Black Chrysler, and showed that photo to the private investigator. The money was in two large plastic bags, according to merit board testimony.

The man who was suppose to receive $250,000 from Woods told the private investigator that he went to the McDonald's, but no one ever showed up. The private investigator told merit board members he noticed the Black Chrysler he was driving was not the same Black Chrysler shown to him by Woods.

Sheriff Galloway also interviewed Deputy Teresa Woods about the so-called missing money.

"She knew about keeping a large amount of money for a friend in their safe," said Galloway, "and although she claims she did not know the amount, she failed to question where the money came from, saying their friend is just not fond of banks and asked them to keep it."

Wednesday, March 26, 2014

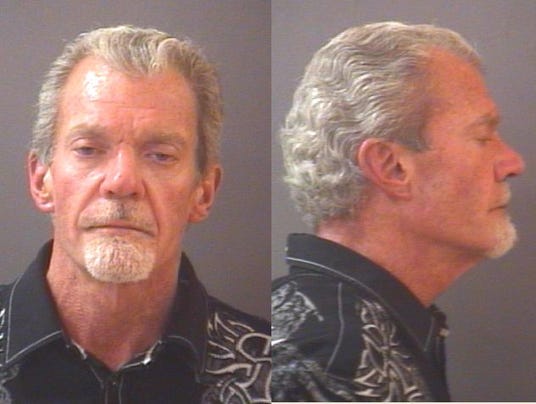

Colts Owner Jim Irsay Had Over $29,000 In Cash Stuffed In Brief Case And Laundry Bag At Time Of OWI Arrest

In addition to being drugged and disoriented at the time of his arrest, Colts owner Jim Irsay had more than $29,000 in cash stuffed in a brief case and laundry bag in his automobile according to a Carmel Police Department arrest record obtained by the Indianapolis Star. No wonder he's so popular with our local politicians. The arresting police officer also found prescription drug bottles containing pills in the briefcase and other bags stored in Irsay's vehicle after he stopped him for driving erratically at 11:40 p.m. on March 16, 2014.

When the officer first pulled Irsay over, the report indicates that he told the officer that he had become confused in trying to find his home. His home on 116th Street was 3.5 miles from the scene of his arrest; however, the Star report indicates that Irsay recently acquired a second $1.4 million home in West Clay, which was less than a half-mile from where he was stopped. The police report describes Irsay's speech as "very slow and slurred" and indicated that Irsay "appeared to be disoriented." "I also observed that his eyes were red and watery. He also displayed poor manual dexterity." Irsay failed several field sobriety tests and had difficulty standing according to the report.

There were 11 pieces of evidence identified in the police report as "drugs/prescription." The report didn't distinguish whether that referred to 11 pills or 11 different types of pills. The report also didn't identify the type of pills seized by police. Police charged Irsay with four felony counts for possession of controlled substances, along with driving a vehicle while intoxicated. Police believed Irsay's intoxication was caused by drugs and not alcohol, although Irsay refused to voluntarily submit to a blood alcohol test. Results of a portable breathalyzer test were redacted from the police report according to the Star. Irsay declined to answer police questions after being transported to the Hamilton County jail without the presence of his attorney.

The Hamilton Co. Prosecutor's Office, which has yet to file any formal criminal charges against Irsay, agreed to postpone his initial hearing this week. Irsay has voluntarily admitted himself to an out-of-state rehab center for treatment of his drug addiction. More than a decade ago, news reports uncovered the fact that Irsay had been hospitalized at least three times for drug overdoses. Despite evidence that Irsay had engaged in prescription drug fraud to obtain controlled substances, local law enforcement authorities agreed not to pursue criminal charges against him after the downtown mafia expressed concern that he might lose ownership of the Colts if he faced felony drug charges.

Phony Conservative Governor Signs Mass Transit Boondoggle Legislation Into Law

Prepare to bend over and take it up the butt from fake Republican Mayors Greg Ballard, James Brainard and Andy Cook after they've been given the green light to hit you up for another local income tax increase to finance a regional mass transit boondoggle that will give an unelected, unaccountable regional authority control over billions of dollars in new taxing, spending and borrowing authority. Gov. Mike Pence said that, while he had "reservations about the sustainability of expanded mass transit services," he signed it into law anyway because it contains "no new, corporate tax." So what if taxes on individuals will increase sharply. This governor is absolutely at war with the working men and women of this state. His primary goal is to shift as many taxes away from businesses onto the backs of the working people as he possibly can. He could give a damn less about the tax burden on average Hoosiers.

Here's a sampling of videos to demonstrate just why anyone who can avoid public transit will do so no matter how much of our tax dollars are spent subsidizing it.

Charlotte Mayor Arrested In FBI Sting For Accepting Bribes

It's standard operating procedure in the City of Indianapolis, but in other cities there is something called a U.S. Attorney and FBI agents who work to weed out corrupt politicians who are accepting bribes in exchange for handing out hundreds of millions of our tax dollars to private real estate developers. Charlotte Mayor Patrick Cannon (D) was arrested today on public corruption charges uncovered through an FBI sting. The U.S. Attorney's Office in North Carolina says that the investigation began years ago when federal law enforcement officers were tipped off about alleged illegal activities undertaken by Cannon, whose city hosted the 2012 Democratic National Convention. Cannon, a former city council member, was elected mayor last November after President Obama named his successor, Anthony Foxx, as Secretary of the Department of Transportation.

During the course of that probe, the mayor allegedly accepted bribes from undercover FBI agents on five separate occasions, in exchange for access to city officials responsible for planning, zoning and permitting.

A criminal complaint said Cannon is accused of soliciting and accepting more than $48,000 in cash, airline tickets, a hotel room and the use of a luxury apartment as bribes.

During the last encounter, according to the U.S. attorney's office, he accepted $20,000 in cash.

If convicted on all the charges, he faces 20 years in prison and more than $1 million in fines . . .

Cannon was also accused of accepting $12,500 from an undercover agent to help him develop a feminine hygiene product called "Hers" to be marketed and sold in the United States. In exchange, Cannon offered to help the undercover agent -- posing as a business manager for a venture capital company -- get the necessary permits to open a nightclub.

During the meeting, an undercover agent told Cannon: "You know, again whatever you can do to get our application moved up towards the top, uh, business license and things like that, that we need."

According to the complaint, Cannon responded: "Yeah, not a problem."Separately, Mercury News reports that the FBI also conducted a series of raids in San Francisco and Sacramento that included the arrest of State Sen. Leland Yee (D-San Francisco) on public corruption charges. Yee had been expected to be the Democratic Party's candidate for Secretary of State this year. Yee's arrest coincided with the arrest of a Honk Kong gang leader, Raymond "Shrimp Boy" Chow, on a variety of racketeering and drug-related charges. Federal officials would not say whether Yee's arrest was linked to Chow. Yee is the third California state lawmaker facing criminal charges this year. In February, State Sen. Ron Calderon (D-Montebello) was indicted on bribery charges. In January, State Sen. Roderick Wright (D-Inglewood) was convicted of voter fraud and perjury stemming from a 2010 indictment.

UPDATE: An updated report by the Mercury News indicates that arms trafficking is among the charges Yee is facing. Naturally, Yee's legislative record is hostile to gun owner rights.

The New York Observer has details on an FBI raid of the offices of Bill Scarborough, a Democratic state assemblyman from Queens today. Early reports indicate that the feds are investigating discrepancies in Scarborough's travel expense reporting.

Dirty Harry Reid Caught Giving $17,000 In Campaign Money To Granddaughter For "Holiday Gifts"

The Las Vegas Sun reports that Senate Majority Leader Harry Reid (D-NV) has been forced to repay $17,000 to his campaign committee after FEC investigators questioned him about two payments listed as "holiday gifts" made to his granddaughter, 23-year old Ryan Elizabeth Reid of Berkeley, California, in December, 2013. Reid claimed the purpose of the payments to his granddaughter was to pay for gifts to staff and campaign supporters. According to the Las Vegas Sun, Reid's granddaughter ran a now-defunct business making jewelry. “I thought it would be nice to give supporters and staff thank-you gifts that had a personal connection and a Searchlight connection,” Reid said in a prepared statement. “But I have decided to reimburse the campaign for the amount of the expenditure.” I don't what kind of crime Reid is going to have to commit before the man is finally thrown in prison where he belongs. The guy is the biggest crook in the U.S. Senate. The Washington Times recently revealed that the Obama Justice Department blocked a federal investigation into Reid's corrupt activities.

Ethics Statements For City-County Council Missing For The Past Two Years

A few weeks back, I inquired of a member of the Indianapolis City-County Council why ethics statements for all of the council members for the past two years have not been posted on the council's website. After inquiring with the clerk, the council member informed me that the statements posted online were up-to-date and that the statements filed in January would be posted shortly. When I informed the council member that the last statements made available were those filed in January, 2012 for the 2011 calendar year, the council member assured me the matter would be corrected shortly. We're still waiting.

The Man Who Could Be Your State Treasurer

A Marion Chronicle-Tribune editorial has this to say about its city's mayor, who is asking Republicans to this year's state convention to nominate him as its 2014 State Treasurer candidate:

Of all the matters we find outrageous regarding the unaccounted millions of dollars of tax money in the effort to rehabilitate the old YMCA on Third Street, what is most disappointing is that we, the people, should have known it would go as it has gone.

That is because the financial story of local city government is often not told completely and correctly, according to state auditors.

Marion has a history of poor record-keeping, according to its annual audits by the state. The Indiana State Board of Accounts cited inconsistent bank account reconciliations in the city’s 2004, 2008, 2009, 2010 and 2012 audits. The latest audit, for 2012, was released in September. The one for 2013 is about to start.

As reporter Karla Bowsher previously reported, state auditors noted entire departments were missing from the city’s 2011 and 2012 annual statements — both of which also underestimated the city’s outstanding leases and debts by at least $9 million. Financial records for another bond anticipation note, taken out in 2010 for up to $3.5 million, also showed omissions. The 2010 BAN was refinanced in December like the $2.5 million YMCA bond.

“Some deposits and checks that were posted to the demand deposit account were omitted from the city financial records,” the 2010 audit states. “Drawdowns from a $3.5 million line of credit and disbursements for land purchases, professional fees and site development expenses were not recorded.”

So how many times does it have to happen before something is done to make the administration accountable for the money we trust it with?

It is a question to be answered, perhaps this year.

BP's Whiting Refinery Spills Oil Into Lake Michigan

Oil spilling from BP's Whiting refinery into Lake Michigan was supposed to be an impossibility, but the impossible has happened this week as crude oil leaked into the refinery's sealed cooling system that circulates water between Lake Michigan and the refinery. According to the Chicago Tribune, oil is never is supposed to come in direct contact with cooling water used at the refinery. Lake Michigan is a source of water for many communities near the Great Lake. Illinois' senators have vowed to hold BP accountable for the spill. "In a joint statement, U.S. Sens. Dick Durbin and Mark Kirk of Illinois said they are concerned that BP’s move to increase production could lead to more oil spills," the Tribune reported. "We plan to hold BP accountable for this spill,” the senators said, “and will ask for a thorough report about the cause of this spill ... and steps are being taken to prevent any future spill. Indiana officials, who generally don't give a damn about environmental protection, had nothing to say.

Indianapolis Diverts Nearly $120 Million Annually To TIF Slush Funds

UPDATED: Fellow blogger Pat Andrews continues to do yeoman's work ignored by the mainstream media about the financial hole created in Indianapolis' city-county budget through the diversion of property tax revenues to TIF slush funds used to finance development projects for the politicians' campaign contributors. The latest numbers she's obtained from the Marion County Auditor's Office show that Indianapolis' far-flung TIF districts are expected to capture close to $118 million this year in property tax revenues. The consolidated downtown TIF district alone will capture $68 million. About $2 billion worth of the assessed value of real property in Indianapolis falls within a TIF district. These figures don't even account for the hundreds of millions of dollars lost annually through property tax abatement passed out by the administration and council to reward campaign contributors.

The numbers for the new North Midtown TIF are quite startling. In its first year of operation, the TIF district went from a zero increment to $470,000 despite the fact that there was no new construction to add to the TIF's increment, $283,000 worth of property within the district was demolished and over $755,000 came off the tax rolls due to tax abatements awarded by the council. So how could $470,000 be attributed to the increment? According to Andrews, all property tax abatements granted prior to the creation of the TIF district are attributed to the newly-created TIF district. Note: Andrews corrected her initial number for the North Midtown TIF, which was incorrectly stated as $470 million instead of $470,000. She now estimates the old abatements will spin off about $4 million to the TIF district over the next decade.

Meanwhile, the Ballard administration is gloating over another planned downtown development being announced today that Cummins intends to build a $30 million corporate office building downtown on the remaining Market Square Arena property adjacent to Flaherty & Collins' planned 28-story, high-rise luxury apartment building to which the downtown TIF will contribute at least $40 million over the next 25 years. According to the Star, Cummins will receive a 10-year tax abatement and will be donated the land valued at $4.3 million. The City will also spend $3.3 million to build a new parking garage and other infrastructure improvements for Cummins. Add up all the benefits and city taxpayers are fronting at least one-third of the cost of constructing the $30 million building. The office building will house up to 400 employees, about 100 of which will initially come from office space the company currently leases at two other downtown locations. Cummins plans to transfer about 150 employees from its Columbus office to the new location.

You people need to ponder these numbers very carefully. This administration and our city-county council will be going public with a plan to raise your taxes within the next few months, which you will be told is absolutely necessary to adequately fund public safety and pay for basic city services. That's in addition to the new income tax the mayor and council intend to levy on you to pay for an expansion of the mass transit system into a regional system that extends into the suburbs. In 2007, your income taxes were raised 65% for what was dubbed as a public safety tax increase. This administration and council diverts more money to the TIF slush funds every year than you started paying in higher taxes back in 2007. We don't have money to pay for basic services because these rat bastards believe that funding the private development projects of their largest campaign contributors is more important than spending our money for the purposes it was intended to be spent. TIFs are nothing more than a criminal racket that grants a license to our elected officials to steal our tax dollars and give them away to people stuffing money in their pockets. Until you rise up and stop this madness, this criminal racket will continue unabated, your taxes will keep rising and your standard of living will continue to fall as it has precipitously over the past several years. You must get in the politicians' faces, show them your intense anger and make them fear for their political lives if you expect any changes to come.

Yesterday, Gov. Mike Pence signed into law massive tax cuts for businesses that will do nothing more than create a shift in taxes to individuals. The corporate tax rate is being slashed to a rate Gov. Pence boasts will be the second-lowest in the country. That legislation also allows local governments to award super tax abatements to businesses for up to 20 years on their personal property business taxes. That's likely to set off a competition among communities across the state to see who can outdo other communities in offering larger tax breaks to attract businesses to move within the state to localities promising the least amount of taxes. Somebody has to pay for all of this madness, and the burden will ultimately fall on individual taxpayers. You mark my word.

The numbers for the new North Midtown TIF are quite startling. In its first year of operation, the TIF district went from a zero increment to $470,000 despite the fact that there was no new construction to add to the TIF's increment, $283,000 worth of property within the district was demolished and over $755,000 came off the tax rolls due to tax abatements awarded by the council. So how could $470,000 be attributed to the increment? According to Andrews, all property tax abatements granted prior to the creation of the TIF district are attributed to the newly-created TIF district. Note: Andrews corrected her initial number for the North Midtown TIF, which was incorrectly stated as $470 million instead of $470,000. She now estimates the old abatements will spin off about $4 million to the TIF district over the next decade.

Meanwhile, the Ballard administration is gloating over another planned downtown development being announced today that Cummins intends to build a $30 million corporate office building downtown on the remaining Market Square Arena property adjacent to Flaherty & Collins' planned 28-story, high-rise luxury apartment building to which the downtown TIF will contribute at least $40 million over the next 25 years. According to the Star, Cummins will receive a 10-year tax abatement and will be donated the land valued at $4.3 million. The City will also spend $3.3 million to build a new parking garage and other infrastructure improvements for Cummins. Add up all the benefits and city taxpayers are fronting at least one-third of the cost of constructing the $30 million building. The office building will house up to 400 employees, about 100 of which will initially come from office space the company currently leases at two other downtown locations. Cummins plans to transfer about 150 employees from its Columbus office to the new location.

You people need to ponder these numbers very carefully. This administration and our city-county council will be going public with a plan to raise your taxes within the next few months, which you will be told is absolutely necessary to adequately fund public safety and pay for basic city services. That's in addition to the new income tax the mayor and council intend to levy on you to pay for an expansion of the mass transit system into a regional system that extends into the suburbs. In 2007, your income taxes were raised 65% for what was dubbed as a public safety tax increase. This administration and council diverts more money to the TIF slush funds every year than you started paying in higher taxes back in 2007. We don't have money to pay for basic services because these rat bastards believe that funding the private development projects of their largest campaign contributors is more important than spending our money for the purposes it was intended to be spent. TIFs are nothing more than a criminal racket that grants a license to our elected officials to steal our tax dollars and give them away to people stuffing money in their pockets. Until you rise up and stop this madness, this criminal racket will continue unabated, your taxes will keep rising and your standard of living will continue to fall as it has precipitously over the past several years. You must get in the politicians' faces, show them your intense anger and make them fear for their political lives if you expect any changes to come.

Yesterday, Gov. Mike Pence signed into law massive tax cuts for businesses that will do nothing more than create a shift in taxes to individuals. The corporate tax rate is being slashed to a rate Gov. Pence boasts will be the second-lowest in the country. That legislation also allows local governments to award super tax abatements to businesses for up to 20 years on their personal property business taxes. That's likely to set off a competition among communities across the state to see who can outdo other communities in offering larger tax breaks to attract businesses to move within the state to localities promising the least amount of taxes. Somebody has to pay for all of this madness, and the burden will ultimately fall on individual taxpayers. You mark my word.

Tuesday, March 25, 2014

Three Arrested In Warsaw Overbilling Scheme

Two employees of ProForm Pipe Lining Company in Mishawaka and the City of Warsaw's public works superintendent were arrested today as part of a joint federal, state and local investigation into allegations that the three men were engaged in a scheme to overbill Warsaw's public works department for work performed by the Mishawaka company. According to the Journal-Gazette, the FBI simultaneously executed four search warrants and arrest warrants for the men's arrest. Arrest warrants were served on the following three individuals:

Kevin R. Brown , 45, of Mishawaka, identified by police as a ProForm field supervisor, on charges of corrupt business influence; aiding, inducing or causing theft; and four counts of providing false information to a governmental entity to obtain contract.

Marc V. Campbell, 53, of Mishawaka, identified by police as ProForm's owner and president, on charges of corrupt business influence; theft; and four counts of providing false information to a governmental entity to obtain contract.

Lacy Francis Jr., 59, of Warsaw, identified by police as the former Warsaw city Public Works superintendent, on charges of corrupt business influence; aiding, inducing or causing theft; two counts of theft; providing false information to a governmental entity to obtain contract; two counts of official misconduct; and conflict of interest.

According to the report, Warsaw's Mayor Joe Thallemer sought the investigation after he learned of potential billing discrepancies last December. The investigation uncovered overcharges during a two-year period exceeding $250,000 from May 2011 to May 2013.

According to the report, Warsaw's Mayor Joe Thallemer sought the investigation after he learned of potential billing discrepancies last December. The investigation uncovered overcharges during a two-year period exceeding $250,000 from May 2011 to May 2013.

Hamilton County Prosecutor's Office Still Hasn't Filed Charges Against Irsay, Preliminary Hearing Cancelled

You can't conduct an initial hearing in a criminal case if the prosecutor's office hasn't filed charges. More than a week after Carmel Police arrested Colts owner Jim Irsay for driving under the influence and four felony counts of possession of controlled substances, the Hamilton Co. Prosecutor's Office cancelled a scheduled initial court appearance for Irsay because the office has yet to file any formal charges against Irsay in the case. The AP reports that no hearing will take place "unless or until" formal charges are filed against him. "Hamilton County Chief Deputy Prosecutor Andre Miksha said prosecutors aren't bound by preliminary booking charges."

This is the same prosecutor's office which: failed to charge Nancy Irsay after eyewitnesses fingered her in a hit-and-run incident; claimed no criminal charges could be brought against a Fishers physician who served alcohol at a party in his home to an under aged teen who later died after leaving the physician's residence and driving his car into a retention pond where he drowned; and declined to press rape charges in the past against Carmel High School basketball players or swim team members who sodomized male teammates as part of a twisted hazing ritual. So yeah, it wouldn't be surprising if this same prosecutor's office drops some, if not all, of the charges against Irsay.

This is the same prosecutor's office which: failed to charge Nancy Irsay after eyewitnesses fingered her in a hit-and-run incident; claimed no criminal charges could be brought against a Fishers physician who served alcohol at a party in his home to an under aged teen who later died after leaving the physician's residence and driving his car into a retention pond where he drowned; and declined to press rape charges in the past against Carmel High School basketball players or swim team members who sodomized male teammates as part of a twisted hazing ritual. So yeah, it wouldn't be surprising if this same prosecutor's office drops some, if not all, of the charges against Irsay.

Former CHAMP Car Series Owner Defrauded Out Of $3 Million By 29-Year Old Fertilizer Salesman

|

| Gerald Forsythe |

According to the opinion, Forsythe, whose reported net worth was $600 million many years ago, entered into an oral agreement on July 6, 2004 with Yeley, who he came to know when he sold him fertilizer for his vast farming interests in Illinois, to purchase Cabela's stock when its initial public offering was launched. Forsythe agreed to put up $3 million, which he transferred into a brokerage account opened up by Yeley at Pershing, LLC. The funds were to be used solely by Yeley for purchasing Cabela's stock and when the stock was sold the two were to share in any profits realized from the sale of the stock. The two also agreed that Forsythe could demand the return of his money at any time. You can pretty much guess what happened thereafter.

Forsythe cut a check made payable to the brokerage account at Pershing for $3 million from Indeck Energy Services. Shortly after the deposit was made, Yeley began withdrawing funds from the account and transferring them into his personal bank accounts. Between September 24, 2004 and December 18, 2006, Yeley withdrew a total of $2,365,939 from his Pershing account, which he spent on personal expenses. What little of the money Yeley used to purchased Cabela's stock, he wound up selling for a loss. He also used part of the money to buy stock in a different company. On November 1, 2006, Forsythe asked Yeley to sell enough of the Cabelas' stock in order to return the $3 million "loan" he provided to him. Yeley tendered a $3 million check payable Forsythe drawn on an Old National Bank account, but he told Forsythe to hold the check until he had marshaled all of the necessary funds to cover the full amount of the check. Not surprisingly, Yeley never came up with the funds necessary to allow the bank to honor the check.

In 2007, Forsythe sued Yeley, his former spouse and Pershing, alleging breach of contract and conversion. The court opinion does not say how that case ended, but in January, 2012, Yeley filed for Chapter 7 bankruptcy protection in the bankruptcy court in Terre Haute to avoid Forsythe's $3 million claim against him. Yeley alleged that Forsythe used him to launder the money because he was supposedly barred from participating in Cabela's initial public offering, although Judge Lawrence's opinion says that Yeley did not produce evidence to prove his claim. At a trial held last year, the bankruptcy court found Yeley liable to Forsythe for $1.5 million and, while it granted him a discharge from bankruptcy, it found that Yeley's $1.5 million debt owed to Forsythe was non-dischargeable. Forsythe appealed the bankruptcy court's decision, arguing that the judgment should have been for the full $3 million, and that Yeley should be denied discharge from bankruptcy due to his fraud.

The bankruptcy court had reasoned that Forsythe shared some of the responsibility for his loss by "doing what he did with who he selected." Judge Lawrence agreed, in part, with Forsythe in concluding that Yeley should at least be responsible for the more than $2.3 million he drew out of the account to spend on personal expenses. On remand, Judge Lawrence ordered the bankruptcy court to determine the exact amount that Yeley acquired through fraud and set that amount as the non-dischargeable debt still owed to Forsythe. Judge Lawrence, however, sided with Yeley in finding that he had not engaged in acts of dishonesty through the filing of his bankruptcy petition. Forsythe had argued that Yeley had failed to file tax returns, failed to disclose interests in businesses, failed to provide documentation of his financial affairs and respond to discovery requests and could not document the dissipation of large sums of money, as a basis for arguing that Yeley had engaged in fraud throughout the bankruptcy proceeding. Judge Lawrence deferred to the bankruptcy court judge's determination that there was "no overt effort in the petitions to mislead anybody or lead them down the road that they shouldn't go."

By way of disclosure, I'm from Marshall, Illinois and am a little more familiar with the involved parties than a person with a passing interest. Yeley's family farms near my parent's farm, and our families are well-acquainted with one another. Forsythe has bought up a great deal of farmland around my parents' farm and doesn't shy away from showing off his wealth. It's no secret that Chris has been fighting a lot of demons and has been in and out of rehab over the years. What is difficult for most people in the community to figure out is why a highly-successful businessman like Forsythe would have ever entrusted $3 million with Yeley based solely on an oral promise and an arrangement that included virtually no adult supervision by Forsythe of Yeley's activities. When Chris started spending money like a millionaire buying expensive homes in an upscale subdivision in Terre Haute and down on Dale Hollow Lake, people around town knew instinctively that something was amiss. I'm told that he made no secret of the claim that he was laundering money for Forsythe. Forsythe never engendered much sympathy in the Marshall community by boasting to anyone within ear shot how little he paid in taxes to the government because of his business acumen. Frankly, if I had been in Forsythe's shoes, I would have been too embarrassed to have resorted to the courts to recover the money he essentially gave to Yeley.

Forsythe, who is from Marshall originally, made his fortune from Indeck, a family of companies that specialize in the sale and lease of power-generating equipment, as well as owning and operating cogenerating power facilities throughout North America. He also owns tens of thousands of acres of farmland in Illinois, car dealerships, banks and auto racing tracks. Indy Car fans will recall that he once owned a race team that featured a number of prominent race car drivers, including Teo Fabi, Greg Moore, Patrick Carpentier, Alex Tagliani and Paul Tracy. Forsythe was best known in auto racing as the guy who hated Tony George and wanted no part of his IndyCar series.

Forsythe owns the largest house in Cook County, Illinois, a nearly 25,000 square foot home in Inverness, and perhaps the most ritzy log cabin home in all of North America in rural Marshall that features an 18-hole golf course rated as one of the best private golf courses in the country by Golf Digest. Forsythe likes telling the story about Peyton Manning calling him up and asking to play on his golf course. Forsythe told him he would be happy to have him visit his golf course. After Forsythe told Manning how much he would have to pay for a round of golf, Manning said no. He mistakenly assumed he could play for free as a guest because of his celebrity status. Forsythe is much more generous with his money towards the politicians, mostly Republicans, having contributed hundreds of thousands of dollars to various candidates and political action committees over the past two decades.

Believe me, Forsythe will never miss that $3 million. If I had known he was passing out money like candy, I would have approached him myself long ago for a "loan." Who knew? I'll never forget going to a CART race down in Homestead, Florida with my brother, who worked for Forsythe at the time, and my nephews on guest tickets we thought had been given to us by Forsythe. Rock singer Lenny Kravitz was a special guest of Forsythe, and Forsythe's racing team had two drivers that day, Greg Moore, who won the race, and Patrick Carpentier. Moore refused to mingle with Forsythe's invited guests at a race party following his win, which angered Forsythe. I'll still never forget my reaction when Forsythe came over to my brother to collect money from us for the cost of each of our tickets. I looked at my brother and said, "You're kidding, right?" I reached into my wallet and paid for cost of the ticket in cash, even as I couldn't help but think what a cheap skate Forsythe was.

A few years ago, Forsythe wanted to treat his high school classmates in Marshall to a class reunion they would never forget. They boarded buses in Marshall and were taken to Terre Haute's historic Indiana Theater, where they were treated to a surprise live performance by singer Wayne Newton. Forsythe turned red-faced when his "close friend" Newton got his wife's name wrong during introductions. I wondered if Newton had to fight for his performance fee after that faux pas.

UPDATE (4-25-14): Advance Indiana received an e-mail this week from Chris Yeley concerning the facts described in the post above. He sought to clarify that the home in Allendale in which he lives is owned by his father and rented to him by his father. The public records for the property show that ownership of the home was transferred to him by a trustee's deed on November 6, 2008. On the following day, the property was transferred by quit claim deed from Chris to his father, Norman P. Yeley, from whom he now says he rents the property. As to the information Advance Indiana reported on the Dale Hollow home, Chris says that information is incorrect and that he has never been to the lake. Yeley sought to clarify his role in acquiring the Cabella's stock with facts not included in the court's opinion and to explain how he believed that Forsythe contributed to his financial predicament by allegedly stiffing him on purchases he made from him:

One thing that was never mentioned was the Barge Load of potash that Forsythe had me buy then stuck me with. Or the Anhydrous Ammonia he wanted but would not pay for. He did pay for part of his ammonia but in typical Forsythe fashion he changed the deal. He was supposed to have a tank but instead wanted it all delivered to the field. When the stock was down under 6 dollars and Jerry had stuck me with these kinds of debts what do you do. I wish I had never met him . . . Jerry wanted me to buy the stock on margin and he said he would bare all loss. He told me to buy five million. The order was put in but when Jerry sent me three million I was already in trouble before the thing got started. You can't buy an IPO on margin and it was a setup from the beginning. I made a lot of mistakes no doubt. I just didn't know what to do when he started stiffing me on purchases. A barge load of potash goes for around a million dollars by the way and when the stock is 70% less that what it was when you purchased it what do you do?

Monday, March 24, 2014

Ballard Administration Fails To Comply With ROC Subpoena

The Ballard administration's conspiracy to cover up multiple possible criminal law violations committed to defraud Indianapolis taxpayers out of tens of millions of dollars in order to reward a campaign contributor continues unabated. Fox59 News' Russ McQuaid reports that the administration ignored a deadline to respond to a subpoena issued on March 10, 2014 by the ROC Investigating Committee to produce dozens of documents the committee has sought from the administration for more than four months. A few outstanding document requests trickled in to the council's attorney's office after the deadline passed but many others were not produced. According to news reports, former Public Safety Director Frank Straub ordered many documents related to the controversial 25-year, $20 million lease for the regional operations center shredded after his forced resignation but before he left his job to become the new police chief for the Spokane, Washington police department. The committee may have to go to court to force the administration to comply with the subpoena. Here's more from McQuaid's report tonight:

Unnerved by their pathetic handling of the regional operations center, the Ballard administration is pushing forward with its first public hearing tonight to privatize Marion County's criminal justice system. The plan calls for moving the county's jail, sheriff's department, criminal courts, prosecutors, public defenders and other related criminal justice agencies out of their current downtown locations into a new, single facility. The administration wants to award a long-term, credit lease financing agreement to a private vendor to build, operate and maintain a new criminal justice center at a single location, a plan that will cost taxpayers hundreds of millions of dollars more in the long-run than if the City financed, owned and operated its own facility. The administration's consultant originally picked a site near the county line on the far west side next to the airport as the preferred location. After being bombarded with public criticism, the Ballard administration switched course and announced that its new preferred site is the former GM stamping plant site just west of the downtown across from the zoo on West Washington Street. This has nothing to do with what is best for the taxpaying public; it's all about doing what will provide the biggest financial reward to the campaign contributors stuffing money in the politicians' pockets.

“What we got today is unacceptable and most of it was on the documents request since November,” said Councilman Joe Simpson. “You heard the same story from the word, ‘Go!’ ‘We don’t have them. We don’t know where they are. It’s not my job.’ My job is for you to tell me if you don’t have them, then, why? Where are they?”

Hours after the committee’s deadline, passed over republican objections, passed, Simpson said partial documents began trickling into the council’s attorney from the city’s lawyers.

“There were about ten documents that had no documents attached to it. Some we’re not able to find and four of them, there were no documents period.” . . .Meanwhile, Indianapolis taxpayers continue to shell out nearly $60,000 a month in rent for a building it cannot occupy while it awaits a punch list of more than 100 repair items the City never bothered getting around to identifying until months after it abandoned the building because of its unsafe conditions and only after it entered into a settlement agreement late last year which left the City without any legal remedy, and which ratified the terms of the long-term, credit tenant financing lease agreement that Straub executed without proper authority in 2011 in a rush to get the ROC operating prior to the Super Bowl in 2012. In any other city in America people would be going to jail for all the fraud perpetrated on the public in this deal, but this is Indianapolis where it's an acceptable practice to defraud taxpayers any way you can in order to reward campaign contributors.

Unnerved by their pathetic handling of the regional operations center, the Ballard administration is pushing forward with its first public hearing tonight to privatize Marion County's criminal justice system. The plan calls for moving the county's jail, sheriff's department, criminal courts, prosecutors, public defenders and other related criminal justice agencies out of their current downtown locations into a new, single facility. The administration wants to award a long-term, credit lease financing agreement to a private vendor to build, operate and maintain a new criminal justice center at a single location, a plan that will cost taxpayers hundreds of millions of dollars more in the long-run than if the City financed, owned and operated its own facility. The administration's consultant originally picked a site near the county line on the far west side next to the airport as the preferred location. After being bombarded with public criticism, the Ballard administration switched course and announced that its new preferred site is the former GM stamping plant site just west of the downtown across from the zoo on West Washington Street. This has nothing to do with what is best for the taxpaying public; it's all about doing what will provide the biggest financial reward to the campaign contributors stuffing money in the politicians' pockets.

Minnesota Legislature Asked To Approve Tax Breaks Worth $10 Million To Lure Super Bowl

Minnesota taxpayers are learning that picking up more than half the tab to build a billion-dollar new stadium for the Vikings isn't enough for the greedy billionaire NFL team owners. If the City of Minneapolis hopes to beat out Indianapolis and New Orleans to host the 2018 Super Bowl, state lawmakers will need to approve tax breaks worth at least $10 million to entice NFL owners that their city is worthy of hosting a Super Bowl. The Star-Tribune discusses the battle brewing in the Land of 10,000 Lakes:

UPDATE: Fellow blogger Doug Masson picks up on an executive order that Gov. Mike Pence issued without fanfare earlier this month in which he makes a pledge to the billionaire NFL teams that the state of Indiana agrees that "neither the NFL, the teams, nor any director, shareholder, officer, agency, employee or other representative of the NFL or the Teams shall be held accountable for or incur any financial responsibility or liability of any kind whatsoever in connection with the governmental services planned and/or provided by the State of Indiana relating to Super Bowl LII and related official events." He also pledges state resources to protect against "any unauthorized promotional activities during the two weeks prior through the week following Super Bowl LII and related official events . . . " I guess Gov. Pence is officially a whore for the billionaire NFL team owners. Too bad he isn't as generous with state resources when it comes to ordinary Hoosiers.

A tax relief package designed to lure the Super Bowl to Minneapolis is running up against the limits of bipartisan zeal for cutting taxes at the Capitol this year.

DFL Gov. Mark Dayton met recently with legislative leaders from both parties to press his case, and cautioned against a partisan fight that could doom the state’s Super Bowl bid.

“Life will go on if we can’t keep this out of the partisan politics,” Dayton said. “We’ll just have to let the opportunity go by.”

Under consideration is roughly $10 million in tax breaks for gameday player salaries, NFL Super Bowl events and even tickets to the big game, which can reach $2,600 for the best seats.

Hanging in the balance is a once-in-a-generation opportunity to showcase the state and the new $1 billion Vikings stadium before an international audience totaling hundreds of millions. State leaders must weigh it all against the political consequences of handing out tax breaks to the National Football League and potentially some of the nation’s most highly paid athletes.

Minneapolis is competing against Indianapolis and New Orleans for the right to host the 2018 Super Bowl. With the final pieces of the old Metrodome coming down, stadium officials face a deadline to put together a proposal by next month. A decision is expected in May.

“The new stadium is a significant component in analyzing Super Bowl bids, but that alone won’t deliver it,” said Lester Bagley, Vikings vice president of stadium development. “If the public sector is not fully on board, it won’t work.” . . .

“No, no, no,” said Sen. David Osmek, R-Mound. “Why should we be giving tax breaks to millionaires and billionaires when we can’t fill potholes in Minnesota?”Osmek said the NFL gins up the competition and then works community leaders into a frenzy over who can offer more.

“The NFL is playing us all against each other,” he said. “Why can’t Minnesota be the first one to get off this train and say, ‘Stop?’ If the Super Bowl wants to come to Minnesota, then you pay the same taxes as Joe Taxpayer in Minnetonka.”

The proposal scrambles the usual partisan dynamics around the Capitol, with Republicans speaking stridently against the kind of tax breaks they usually embrace and Democrats open to tax relief for the multibillion-dollar NFL.

House Taxes Committee Chairwoman Ann Lenczewski said she hopes legislators move past the divisive fight over the new stadium, which pulled together one of the most politically diverse and fragile coalitions in recent history.

“People need to think about this a little differently, now that the stadium is approved,” said Lenczewski, DFL-Bloomington. If the economic benefits can be proven, “it probably warrants some help,” she said.

One major snag for many legislators is the proposed tax break for players’ gameday salaries.

Indiana lawmakers approved nearly identical tax breaks for the NFL as part of its efforts to lure the 2012 Super Bowl, a law that remains on the books. As with Indianapolis, the proponents of Minnesota's Super Bowl efforts are throwing out outlandish economic benefit numbers to tout the tax breaks for the billionaire team owners. Boosters of Minneapolis' bid to host the Super Bowl claim that the event will generate over $300 million in economic benefits to the state of Minnesota, although the newspaper notes that some independent analysts put the actual benefit well below $100 million.“If you are an NFL player, and you get to go to the Super Bowl, are you not going to come if your income taxes aren’t exempted that day?” Lenczewski asked. “That one would be off the table, for me personally.” . . .

Experts who study the economic impact of Super Bowls remain deeply skeptical about the sky-high predictions.

Lost in the hoopla over the highly touted benefits, they say, is a list of unaccounted-for costs, like additional law enforcement, preparation and cleanup.

Robert Baade, an economics professor at Lake Forest College, said much of the reported economic impact is for player salaries, souvenirs and other money that leaves the community after the game.

Oftentimes, the hassle of the event drives away people who would have visited the city otherwise. Studies show that this year’s Super Bowl resulted in disappointing occupancy rates for hotels in New York and New Jersey.

“When you consider all of that, the economic evidence is significantly muted, or close to zero in some instances,” Baade said . . .I remain convinced that Indianapolis actually realized no net economic benefit from hosting the Super Bowl in 2012. Public outlays to host the event reached close to $50 million when factoring in all costs, including expenditures and foregone tax revenues. Most of the businesses that saw the greatest windfall from the event were hotels, restaurants, limousine services and other service-related businesses that aren't locally-owned, which means most of the revenue windfall flowed out of the city and state. Many of those businesses even imported temporary workers into the City to work at their establishments who left with the wages they earned following the event. Making matters worse was the over-utilization of hundreds of volunteers by the local host committee instead of putting unemployed persons to work.

UPDATE: Fellow blogger Doug Masson picks up on an executive order that Gov. Mike Pence issued without fanfare earlier this month in which he makes a pledge to the billionaire NFL teams that the state of Indiana agrees that "neither the NFL, the teams, nor any director, shareholder, officer, agency, employee or other representative of the NFL or the Teams shall be held accountable for or incur any financial responsibility or liability of any kind whatsoever in connection with the governmental services planned and/or provided by the State of Indiana relating to Super Bowl LII and related official events." He also pledges state resources to protect against "any unauthorized promotional activities during the two weeks prior through the week following Super Bowl LII and related official events . . . " I guess Gov. Pence is officially a whore for the billionaire NFL team owners. Too bad he isn't as generous with state resources when it comes to ordinary Hoosiers.

State Auditors Office Says Marion Officials Should Have Documentation For More Than $2 Million In Missing Bond Funds Spent On Failed Project

Last month, I discussed the discovery of a Chronicle-Tribune investigative report that uncovered the fact that documentation for more than $2 million Marion city officials spent from a $2.5 million bond issuance for redevelopment of the old YMCA building cannot be furnished. In 2009, Marion Mayor Wayne Seybold's administration obtained city council approval to issue $2.5 million in bonds to aid a Korean businessman from California, Michael An, in redeveloping the closed YMCA building for a mixed use purpose. Two years later, Marion officials refinanced that debt after the project failed with little work to show for the investment and the building still vacant and the property subject to sheriff's sale for failure to pay property taxes. When the Chronicle-Tribune attempted to obtain documentation for how more than $2 million of the bond proceeds was spent, city officials claimed no documentation for the spent funds existed.

The State Board of Accounts tells the Chronicle-Tribune's Karla Bowsher that the $2.5 million in bond proceeds, by law, should have been deposited into a dedicated construction account. "You should have been able to track all those (construction fund expenditures) beginning to end," the State Board of Accounts Charlie Pride told Bowsher. City officials provided the Chronicle-Tribune no bank statements detailing the construction fund account, including receipt for vendor invoices detailing any expenditures spent on renovation work at the YMCA building in response to its public records request. What little documentation was provided showed that renovation work on behalf of An's Global Investment Consulting had been paid out to another company owned by An, World Enterprise Group.

Raising alarming conflict of interest concerns is the fact that Mayor Wayne Seybold's brother, Chad, was employed by and earning money from World Enterprise Group. According to the Chronicle-Tribune, Seybold served as a director of operations and construction for the company at the time. A company owned by Marion Building Commissioner Larry Oradat, Erma's Home Improvement, is suing World Enterprise Group for construction work it claims it is owed by An's company for work on the building. City council members tell the Chronicle-Tribune that they are becoming increasingly concerned, particularly since Mayor Seybold's administration won't comment on the missing documentation for the more than $2 million debt the city is on the hook for repaying with TIF funds.

Meanwhile, a Whitley County businessman, Bill Reece, tells the Chronicle-Tribune that his company, RCM Real Estate, has entered into a contract with An's Global Investment Consulting to purchase the YMCA building. Reece declined to discuss his plans for the building or any work that was supposed to have been completed with the more than $2 million in missing construction funds.

The State Board of Accounts tells the Chronicle-Tribune's Karla Bowsher that the $2.5 million in bond proceeds, by law, should have been deposited into a dedicated construction account. "You should have been able to track all those (construction fund expenditures) beginning to end," the State Board of Accounts Charlie Pride told Bowsher. City officials provided the Chronicle-Tribune no bank statements detailing the construction fund account, including receipt for vendor invoices detailing any expenditures spent on renovation work at the YMCA building in response to its public records request. What little documentation was provided showed that renovation work on behalf of An's Global Investment Consulting had been paid out to another company owned by An, World Enterprise Group.

Raising alarming conflict of interest concerns is the fact that Mayor Wayne Seybold's brother, Chad, was employed by and earning money from World Enterprise Group. According to the Chronicle-Tribune, Seybold served as a director of operations and construction for the company at the time. A company owned by Marion Building Commissioner Larry Oradat, Erma's Home Improvement, is suing World Enterprise Group for construction work it claims it is owed by An's company for work on the building. City council members tell the Chronicle-Tribune that they are becoming increasingly concerned, particularly since Mayor Seybold's administration won't comment on the missing documentation for the more than $2 million debt the city is on the hook for repaying with TIF funds.

Meanwhile, a Whitley County businessman, Bill Reece, tells the Chronicle-Tribune that his company, RCM Real Estate, has entered into a contract with An's Global Investment Consulting to purchase the YMCA building. Reece declined to discuss his plans for the building or any work that was supposed to have been completed with the more than $2 million in missing construction funds.

Sunday, March 23, 2014

Rhode Island's First Gay Speaker Resigns After Law Enforcement Raid On His State House Office And Home

|

| Rhode Island Rep. Gordon Fox (right) with his same-sex partner, Marcus LaFond |

In 2004, the Journal says Fox supported legislation to award a privatization agreement of the state's lottery to GTECH, the same Italian-owned company that Indiana recently awarded control of its Hoosier Lottery. Fox later agreed to pay a $10,000 ethics fine after it was disclosed that he knew that he would get legal work from the lottery giant when he backed passage of the privatization bill. I truly believe there was similar corrupt influence involved in the awarding of the lottery contract to GTECH here in Indiana, but per usual operating procedure, nothing was done about it.

Earlier this year, Fox agreed to pay another $1,500 ethics fine for failing to report $43,000 in legal fees he was paid to prepare loan documentation work for Providence's economic development agency. Many of those loans became an issue in his last re-election campaign after it was disclosed that many of the recipients were not qualified borrowers and many defaulted on their loans. Rhode Island lawmakers are required under state law to disclose all work they do for public agencies. Fox said that he didn't believe he was required to disclose the work because he performed it as a subcontractor for another law firm, a practice that I believe happens here in Indiana quite frequently without the general public's knowledge. It's an easy way for bigger law firms and other vendors that perform work for public agencies to purchase control of other people who serve in state legislatures and as members of county and municipal councils.

The Journal notes that Fox also played a key role in securing a $125 million state loan guarantee for a video company, 38 Studios, which was owned by former Boston Red Sox pitcher Curt Schilling. The company later went bankrupt, leaving Rhode Island taxpayers on the hook to repay $100 million in debt owed by the company. Fox supposedly had close ties to another attorney who brokered the deal.

The highlight of Fox's tenure according to the Journal was the passage of the state's law in 2013 legalizing same-sex marriages, making it the 13th state in the country at the time to do so. In November, 2013, Fox married his long-time gay partner, Marcus LaFond, a hair salon owner, in his State House office. Fox is described as being African-American based on his ethnicity of his mother, who is from Cape Verde.

It's interesting that there are so many public corruption cases taking place in other states involving key state and local officials while our U.S. Attorney's Office does absolutely nothing about corruption that is equally as bad as what we read about being prosecuted in other states. Joe Hogsett should hold his head in shame at his lack of action, but he won't because he knows that he will benefit greatly in the future by protecting the corrupt ruling class that runs the state of Indiana and the City of Indianapolis.

Former LaPorte School Superintendent And Wife Charged With Defrauding Joliet Casino

Randal Thorpe resigned as superintendent of LaPorte County Schools back in January after an arrest in Tunica, Mississippi for allegedly tampering with a slot machine at a casino. Now he and his wife have both been charged with being part of a ring of gambling cheats that manipulated video keno machines at Harrah's Joliet casino. The Post-Tribune reports on the couple's arrest:

Rande Thorpe, 57, and his wife, Virginia, 59, now of Corpus Christi, Texas, are accused of scheming with three Las Vegas residents to rig the machines at a Harrah’s casino in April 2013 so they paid five times the actual winnings, according to an indictment. The alleged accomplices remain at large, authorities said.

The couple are charged with burglary, computer fraud, computer tampering and cheating at a gambling game. They were released after posting 10 percent of their $50,000 bail, and a judge allowed them to return to Texas while the case is pending.

Virginia Thorpe reportedly is also wanted on a fugitive warrant out of Mississippi.

WSBT-TV in South Bend reported that Rande Thorpe was arrested Jan. 22 in Tunica, Miss., for allegedly manipulating a slot machine at a casino there.

Saturday, March 22, 2014

Federal Agents Investigate Former Illinois Lawmaker For Child Pornography

| State Rep. Keith Farnham (Tribune Photo) |

An attachment to the March 7 warrant to search Farnham’s district office indicated agents were searching for “documents in any format and medium pertaining to the possession, receipt or distribution of child pornography” as well as computer files, copies and negatives of child pornography or any documents that depicted minors “engaged in sexually explicit conduct.” Agents also sought accounts tied to any Internet service provider or computer file sharing, according to the records.The Tribune reports that officials from Immigration and Customs Enforcement ("ICE") also seized a laptop computer from his Illinois State House office on Thursday that he used for his legislative work.

Still A Tax Scofflaw After All These Years

As opinionated as radio talk show host Abdul-Hakim Shabazz is about how much our taxes should be in Indiana, one would think he would at least have the common decency to comply with the tax laws that apply to all other Indiana residents. How many decades does he have to live in Indianapolis before he starts paying taxes here like all the rest of us?

Friday, March 21, 2014

IMPD Staffing Commission Wants 500 New Police Officers Despite Claims That Crime Is Falling

The administration of Mayor Greg Ballard insists that crime rates for virtually all categories of crime other than homicide in Indianapolis are down sharply in recent years. Yet an IMPD Staffing Commission established by the City-County Council has just concluded that at least 500 more police officers need to be added to the police force over the next five years. This has nothing to do about public safety. What this represents is another scheme to raise taxes like they did in 2007 when they raised our local income taxes by 65%, or about $90 million a year a that time, supposedly for the purpose of hiring 100 more police officers and funding public safety agencies in general at appropriate levels. Not one additional police officer was added as a result of the 2007 public safety tax increase. The only new police officers hired to maintain current staffing levels was accomplished through a federal COPS grant earmarked for hiring 50 new police officers. Will you be fooled again by our lying public officials? They don't want more money for public safety; they want more money to pass out to their pay-to-play campaign contributors for their development projects that they believe you have a moral obligation to finance.

Hawaii Police Fight To Keep State Law That Allows Them To Have Sex With Prostitutes

Readers may recall our previous discussions about the fact that the Carmel Police Department allows its undercover police officers to engage in sex acts with prostitutes in conducting their investigations. The police claim that most prostitutes are too sophisticated to communicate an actual agreement to perform sex for money before the actual sex act occurs. Believe it or not, the state of Hawaii has long had a state law that expressly allows police officers investigating prostitution to engage in sex acts during their investigations. A bill making its way through the state legislature this year to crack down on prostitution proposed the elimination of the exemption in the law that allowed police officers to have sex with prostitutes. After strong protests from law enforcement, lawmakers restored the exemption. The Associated Press has more on the debate:

Much to my surprise, I learned after my initial reports on the Carmel Police Department's practice of allowing their police officers to have sex with prostitutes that IMPD vice officers have similarly been allowed to have sex with prostitutes, although their rule makes it clear that the prosecutor's office typically won't prosecute the case if a sex act occurs as a matter of policy, which begs the question of why allow it at all.

Honolulu police officers have urged lawmakers to keep an exemption in state law that allows undercover officers to have sex with prostitutes during investigations, touching off a heated debate.